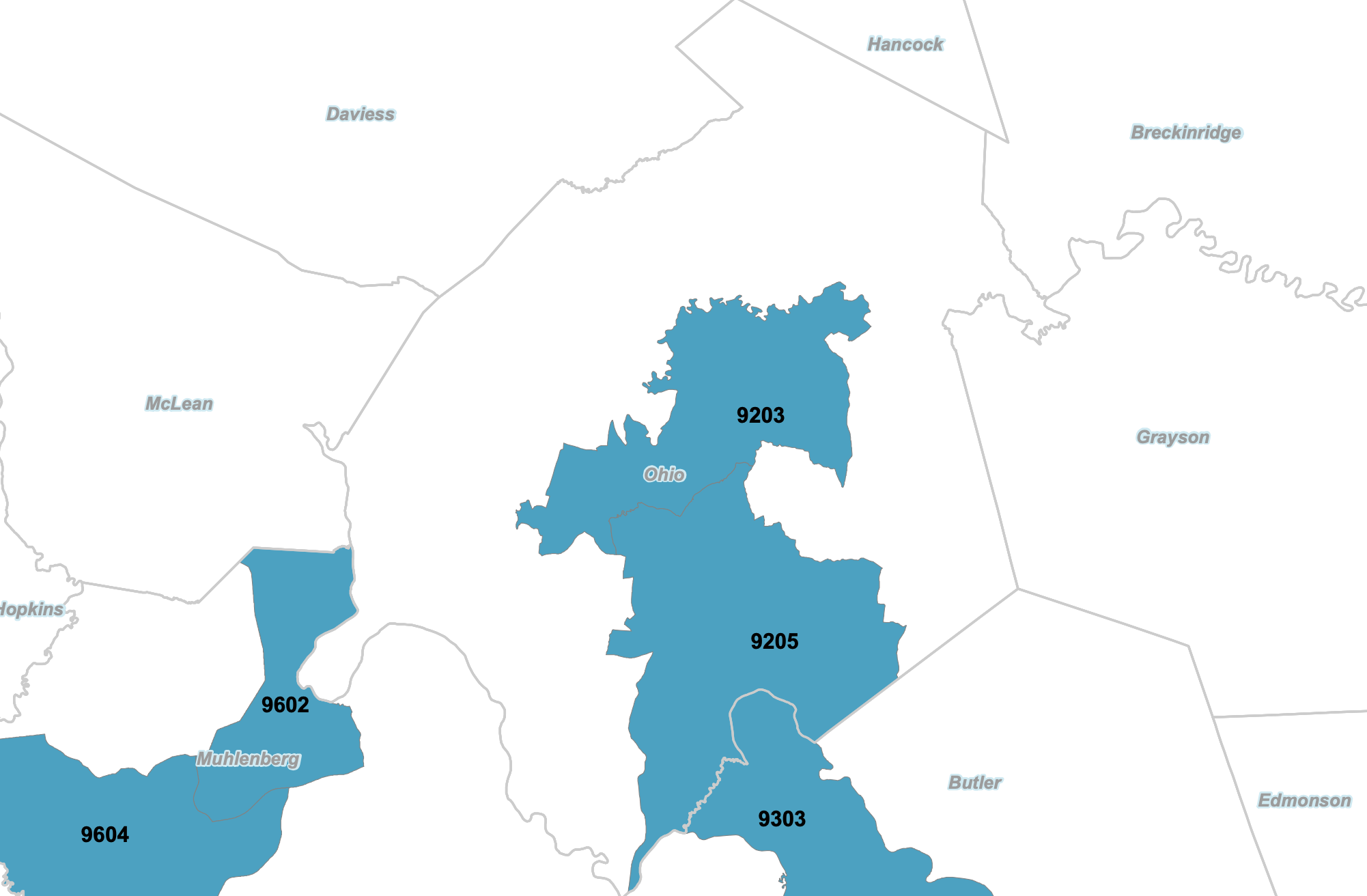

Ohio County Opportunity Zone

Ohio County, Kentucky offers investors the chance to benefit from participation in an Opportunity Zone. These areas are ready for investment and development and ideal for investors looking to make direct investments into businesses or real estate.

What are Opportunity Zones?

Opportunity Zones were created as part of the Federal Tax Cuts and Jobs Act of 2017 (Jobs Act). The purpose was to direct private investment into areas of the country that have not experienced a high level of economic growth and prosperity. By attracting private investment, these areas will have greater opportunities to grow and thrive.

How it works?

After realizing a capital gain, investors must deposit money into a Qualified Opportunity Fund within 180 days. The Fund can be a new or existing business, per the IRS. The money must then be distributed to an Opportunity Zone project.

The Act allows investors to defer all or part of their capital gains when they are invested into a Qualified Opportunity Fund located within an Opportunity Zone. This gain would traditionally be included in an investor’s taxable income. By investing it into a QO Fund, the gain is deferred until December 31, 2026 or when it is sold or exchanged. In addition, by keeping the investment in the QO Fund for ten years, it could be permanently excluded.

Essentially, the Federal Tax Cuts and Jobs Act of 2017 (Jobs Act) has made it possible for individual investors, corporations and trusts to benefit from current economic gains without immediately paying capital gains tax. Those liquidating stocks or selling properties, for example, can invest their gains into Opportunity Zone Funds and instead of paying capital gains tax, have that tax deferred, reduced or even eliminated over time.